By Dan Cremons: https://www.linkedin.com/in/dancremons

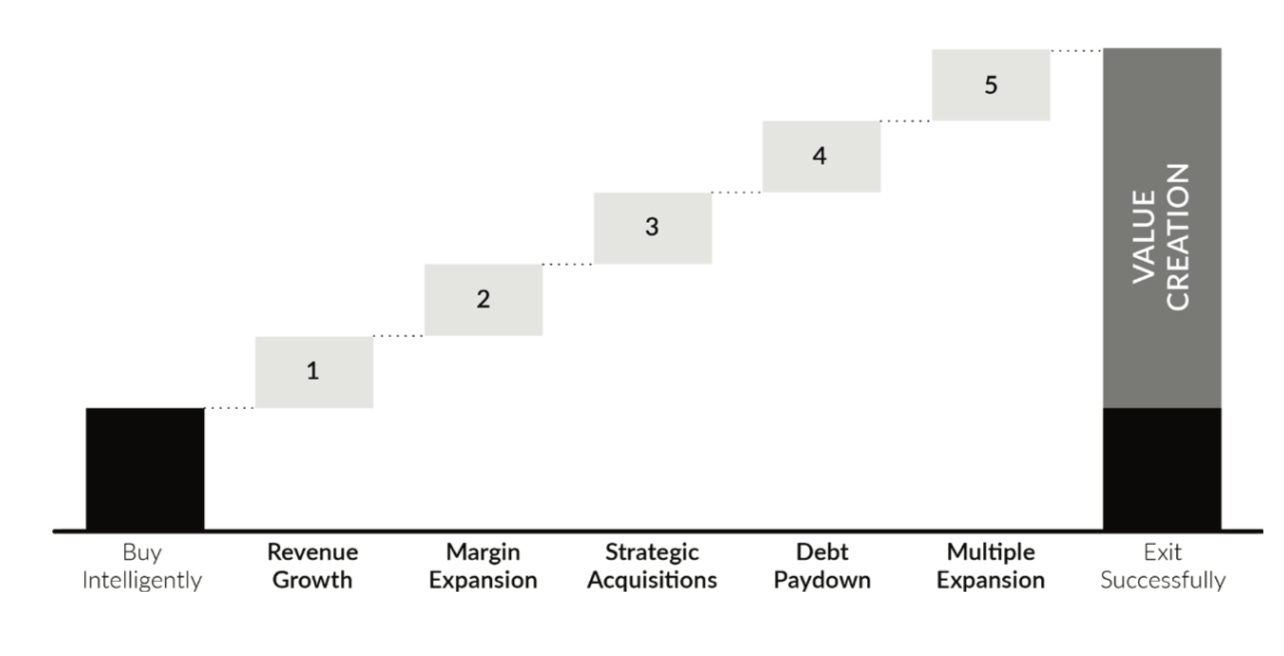

Value creation is the process of proactively and methodically cre- ating equity value during the life of an investment. Simple and accurate as this working definition is, it is unhelpfully broad, so let’s deconstruct how to create equity value in an investor-backed company. At 50,000 feet, there are five basic ways:

If you’re it is growth in equity value that you’re interested in, each of the Fruitful Five—as we can lightheartedly call these levers—can play a role.

This breakdown may seem elementary to the seasoned private equity pros out there, but starting here provides us a simple, approachable mental model to work from. (Wasn’t it da Vinci who said, “Simplicity is the ultimate sophistication”?)

This article is focused on how value is created after an invest- ment is made—during the post-closing period. But there are indeed many ways to enhance the ultimate value of a private equity investment simply by “buying intelligently,” as represented by the left-most bar in the previ- ous graph, including:

1. Market level: Investing in good, growing markets in the first place provides a tailwind to your value creation engine. Driving revenue growth—and in doing so, expanding margins, paying down more debt, and selling for a higher multiple at exit—is con- siderably easier in an industry growing at 15 percent compared with one that’s growing at 5 percent.

2. Purchase price: The lower, the better, eh?

3. Deal structure: Structure can be architected to help investors

mitigate downside exposure and capture more of the upside.

4. Leverage: All else being equal (and ignoring for a moment the potential adverse consequences of over-levering), the less equity

and the more debt, the greater the equity returns will be.

Hope you enjoyed this article !

See ya in the inbox !

Sebastian Amieva

Investor / M&A Expert / Mentor

www.sebastianamieva.com