M&A Monday: The Ingredients of a Purchase Price Offer

By Eli Albrecht / Eli Substack

A good M&A Lawyer is like a chef when crafting the purchase price for an offer to purchase a business. The lawyer, Sponsor, or Searcher uses many ingredients depending on the uniqueness of each deal, seller’s preferences, and the appetite for complexity vs. simplicity. Last week, an Independent Sponsor client submitted a LOI. We got on a call and he said, tell me every component of the purchase price – we need to build something creative. Here are the options for crafting a purchase price along with my commentary on what I am seeing in the market:

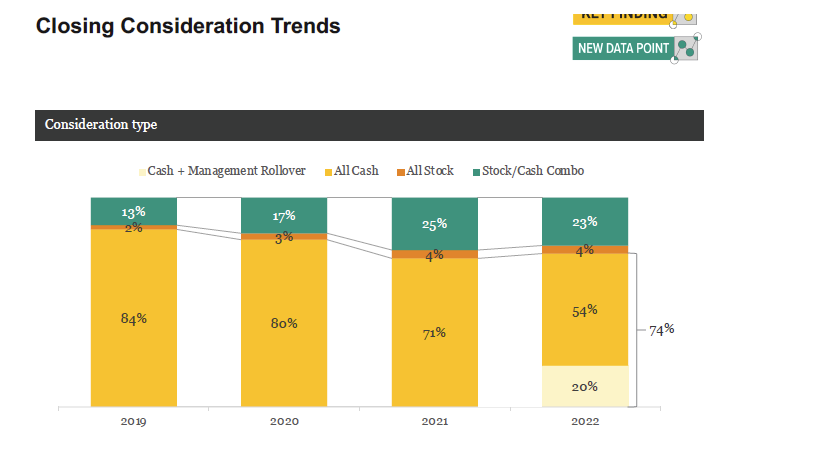

1. Cash at Closing or Closing Consideration. This ingredient needs no introduction. This usually makes up the majority of the purchase price. This is the part of the purchase price most sellers fixate on (Sellers sometimes say, the wire I get at closing is the only wire I can rely on). It is also extremely rare that a seller gets 100% cash at closing in an M&A transaction. I am seeing most offers with around 80% cash at closing.

2. Promissory Note. I have written about my love of the Promissory Note. This is a powerful tool that has many advantages. For the buyer, a note reduces the cash at closing, is subordinate to their senior loan, keeps seller’s skin in the game after closing, and can be used to offset indemnifications. In SBA deals, a correctly structured seller note can be used as part of buyer’s equity requirement. From the seller’s perspective, it allows buyer to offer a higher price, pushes tax liabilities into another year, gives seller an interest payment on their principal, and gives them a creditor position if things go bad. (See, How to Get Seller Comfortable with a Note: https://x.com/Eli_Albrecht/status/1767304931923349648… and How to Structure a Promissory Note: https://x.com/Eli_Albrecht/status/1678389858618818560…) I am seeing seller notes of between 10%-20%, interest rates of between 7%-10%, amortizing over 5-10 years with some period of interest only.

3. Non-Contingent Deferred Payments: Escrow; Holdback. While this is considered almost cash, it is held back from the cash delivered at closing – usually to account for indemnifications or working capital adjustments.

a. Escrow. When part of the purchase price is held by a third party. Use this tool when there is a concern about a diligence issue, working capital fluctuations. Almost every independent sponsor or PE deal has an escrow, however, on smaller deals where there is a seller note, having both a seller note and escrow is very uncommon. It will also make an offer less competitive on smaller deals. I rarely see escrows on deals sub-$10m. (Indemnification, Caps, and Baskets https://x.com/Eli_Albrecht/status/1762228046403170358…) I often see deals foregoing an escrow if they have a promissory note, but when we have one, it is usually 5%-10% of the purchase price

.

b. Holdback. This is the same as an escrow, but the buyer holds the escrow instead of delivering it to a third party. This is an even more aggressive version of an escrow that I use even more infrequently. Sellers are even more allergic to a Holdback than an Escrow. However, like everything, there is a place for this tool as well.

4. Contingent Consideration. Contingent consideration is when part of the purchase price is dependent on a future event. These are tools one should use if there is high customer concentration, unstable or unreliable financials, or a high risk of a business decline.

a. Earn Out. This is more common on IS and PE deals, but not allowed on SBA deals. In BigLaw-M&A, we used to joke that each earn-out we drafted gave the Litigators their billable hours for the coming year. They are always contentious and heavily negotiated. There are tons of nuances and requires very sharp lawyering. An earn out is an amount of money that is paid to a seller at a future date if certain earning thresholds are met. This is usually revenue targets, but can also be EBITDA or key customer targets. If you have an earn out in your deal, you better have a very good M&A lawyer involved. While many larger deals include an earn out (over 20%), earn outs on IS and small PE deals are rarer. I see them on around 5% of my deals and the portion of the purchase price varies widely. More often than not, the earn out is tied to Revenue.

b. Forgivable Promissory Note. This is a promissory note that is forgiven if certain targets are not hit. The SBA allows this as long as it does not look too much like an earn out. Usually, this means if the targets are based in historical performance (e.g., hitting last year’s EBITDA plus reasonable increase (Deep dive into forgivable note: https://x.com/Eli_Albrecht/status/1724081900803731800…). Take care not to create a taxable event when the note is forgiven. This is potentially related to confirmation bias and me pushing my clients to do forgivable notes, but this tool is becoming more popular. I often see up to 10% of the purchase price in a forgivable note and around 10% of my deals include them.

5. Rollover. There should (and will) be a whole post on Rollover. Rollover is when the seller rolls their ownership interest into the Buyer entity. When done right, this results in a tax-free transaction where seller is not taxed on the portion of the purchase price that is rolled. By very careful here – anytime I hear the word rollover, I call our Chair of Transactional Tax at Albrecht Law, Josh Siegel. Rollover is common in IS and PE deals for three reasons:

(1) it reduces the equity raise for the deal,

(2) it keeps skin in the game for seller so they are motivated to make the business succeed, and

(3) sellers generally roll into common units, which is at the bottom of the waterfall (or at least below debt and investors), so it will not impact the privileges of the preferred unitholders. A note on Rollover. SBA recently allowed a partial change of ownership. This is not a true rollover, but rather when the buyer buys a certain percentage of the seller’s business. This requires buyer to do an equity purchase with all the downsides of an equity purchase from a tax and liability perspective (of course, we have ways to deal with that also: Asset vs. Equity: https://x.com/Eli_Albrecht/status/1751969230856028400…) The majority of IS and small PE deals include a Rollover component. In my experience, the rollover is often 20%-30% of the purchase price depending on seller involvement post-closing.

6. Net Working Capital. Working capital is a certain average of current assets minus current liabilities the seller’s business has carried. It is an asset of the business that supports the financials of the business. While not usually thought of as a component of the purchase price, it should be. A higher NWC peg will give the buyer more for their money. A lower NWC peg or no NWC peg is essentially an increase in the purchase price. There are some (like ) who suggested simply increasing the purchase price and not including NWC – there is wisdom to that tactic on smaller deals. PE buyers are famous for using NWC to game the purchase price. If they get a NWC Peg that is higher than the actual NWC Peg at Closing, the purchase price has to decrease.

7. Debt Payoff and Assumption. A good purchase agreement should require part of the purchase price to go straight to pay off indebtedness of the target. Even in an asset deal when debt is not assumed (it is a liability left behind), my purchase agreements force the seller to pay off the indebtedness at closing. This is because the debt may secure the assets that my buyer is acquiring or cause other complications. Sometimes, a buyer will assume indebtedness, which is considered part of the purchase price. I see this missed on so many purchase agreements.

8. Employment Agreements. While not usually thought of as part of the purchase price, a compensation package or consulting agreement with key executives or sellers can be very impactful when winning a deal. Additionally, some acquisitions are Acquihires – very little cash changes hands, but there is a hiring of all or some of the Target’s employees.

I encourage sponsors to think of employment agreements (especially with decision-makers) as one of the levers of a purchase price. A good lawyer will be able to mix and match any of these elements to create the best purchase price for the situation.

*Data charts from SRS Acquiom's 2023 Deal Points study and are more reflective of larger PE deals.

Hope you enjoyed this article !

See ya in the inbox !

Sebastian H. Amieva

Investor / M&A Expert / Mentor